We talk a lot about the ripoff range. When a business or individual defrauds you of $500 to $50,000, the police don’t consider that criminal theft. Instead, the courts view that as a business dispute. That means that the only way for a consumer to get their money back is to sue the party that stole their money. Suing someone in court is a long, complicated process, and even if you win, actually getting your money back could take months or years, and you may never get it. Crooks and scam artists know this, so they target well-meaning consumers with ripoffs in this range. But you don’t have to fall for their scams. The more you learn about how these con artists work, the more prepared you’ll be when one of them tries to take your hard-earned money.

A Questionable Craigslist Interaction

Kim Crawford is a small business owner who makes many of her sales online. She mostly sells through eBay, but she also does some business on Craigslist. Recently, someone contacted her about a chair that she was selling for $800. The communication was via text, and the buyer refused to meet in person or even talk over the phone. That was the first red flag that alerted Kim that something wasn’t as it should be. But she wanted to make the sale, so she agreed to complete the transaction.

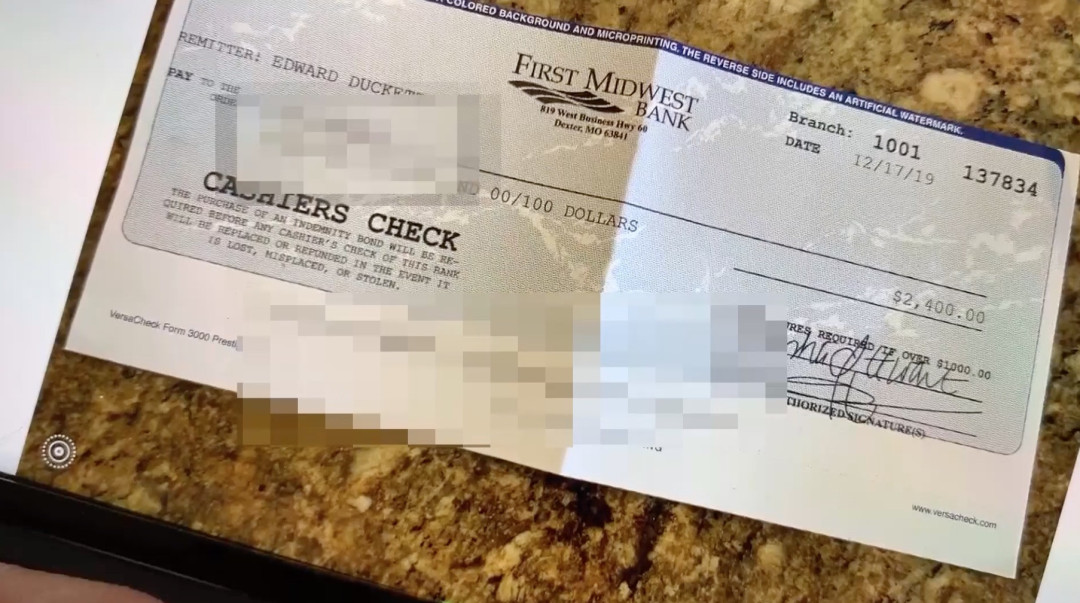

The next red flag was a bizarre request from the buyer. As payment, the buyer sent her a cashier’s check for $2,400, far more than the item cost. When Kim texted the buyer to let them know that the check was for too much, the buyer had an unusual request. They said that they would send a mover to get the chair, and Kim should give the mover the additional $1,600 since the mover would also be moving some other items for the buyer. Kim had never seen that kind of request before, and it seemed like something unusual was going on with this transaction.

Finally, the buyer texted Kim instructions on what to do with the check. They told her not to cash the check, but instead to deposit it and then take out her own money to pay the mover. At this point, Kim was pretty sure this was a scam, so instead of depositing the check, she brought it to the bank to see what they thought of it. They immediately knew this was a scam, confirming Kim’s suspicions. Luckily, Kim caught the scam before it cost her any money.

How This Scam Works

This overpayment scam takes advantage of how banks handle checks. According to the FTC:

“Banks must make funds from deposited checks available within days, but uncovering a fake check can take them weeks. If a check you deposit bounces – even after it seemed to clear – you’re responsible for repaying the bank.”

Con artists create a fake check, often from checks that are stolen out of the mail and then digitally manipulated. Then they ask you to deposit the check and quickly send (or give) them cash before the check bounces. Then, when the check bounces days or weeks later, you’re on the hook for the full amount of the check. By that time, it’s too late.

How Scammers Get Away With It

The police consider this a civil matter, a business dispute between two parties. To retrieve the stolen money, you would have to find the scammers and sue them. And even if you win in court, recovering the funds can be complicated. If the losing party doesn’t voluntarily pay up, you need to get law enforcement involved to retrieve your rightful pay.

There are three main methods for extracting payment from the losing party in a small-claims court dispute. You could seize money from the party’s bank account, but you need the name of their bank, the account number, and the exact name on the bank account. In the case of this con, that information can be hard to find. The second method is a real estate lien. But just like a bank levy, finding property owned by the con artist can be near impossible. Finally, you could try to garnish the con artist’s wages, but you would need to know where the con artist works. In all of these cases, you would need information about the con artist that might be hard to get.

So even a successful claim in court may not lead to getting your money back. In most cases, con artists ask for relatively small amounts, like a few thousand dollars, so their victims won’t feel it’s worth the trouble to try to get their money back. That’s a perfect example of the ripoff range.

Avoid Becoming a Victim

Just like Kim, you can avoid becoming a victim by recognizing the red flags. Always be wary of someone who won’t communicate over the phone or in person. The common method of theft is asking you to deposit a check, keep some for yourself, and ask you to give or wire someone the remainder in cash. Once you know that, you can recognize the scam. Almost no legitimate party would do business that way. Finally, if a deal seems too good to be true, it probably is. No one will just give you thousands of dollars as a fee for passing along some cash. In Kim’s case, the story was a little more realistic, but the strange transaction was still enough to give away the scam.

If you believe you might be involved in a scam, don’t deposit the check. Ask your bank. Most banks are familiar with these scams and can tell you when you’re about to deposit a bad check. Also, never wire money to a stranger. TrustDALE is here to educate you, the consumer, on common scams so you can stay safe!